(Amendment (Amendment No.)

þ | Filed by the Registrant | ¨ |

| ||

Filed by a Party other than the Registrant | |||||

| |||||

Check the appropriate box:

| CHECK THE APPROPRIATE BOX: | |||||

| Preliminary Proxy Statement | ||||

| Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | ||||

| Definitive Proxy Statement | ||||

| Definitive Additional Materials | ||||

| Soliciting Material Pursuant to | ||||

PURE STORAGE, INC.

Payment of Filing Fee (Check the appropriate box)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | ||||||

| No fee required. | |||||

| Fee computed on table below per Exchange Act Rules14a-6(i)(1) and | |||||

| Title of each class of securities to which transaction applies: | |||||

| Aggregate number of securities to which transaction applies: | |||||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 | |||||

| Proposed maximum aggregate value of transaction: | |||||

| Total fee paid: | |||||

| ¨ | ||||||

| Fee paid previously with preliminary materials. | |||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

| Amount Previously Paid: | |||||

| Form, Schedule or Registration Statement No.: | |||||

| 3) | Filing Party: | |||||

| 4) | Date Filed: | |||||

|

| |||

|

|  | ||

| DATE AND TIME | LOCATION | RECORD DATE | ||

| June 20, 2019 at 10:00 a.m. PT | Via live webcast at www.virtualshareholdermeeting.com/ PSTG2019 | April 25, 2019. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. | ||

| ||

650 Castro Street, Suite 400

Mountain View, California 94041

Notice of Annual Meeting of Stockholders

To Be Held On June 20, 2017 at 10:00 a.m. PT

To the Stockholders of Pure Storage, Inc.

On behalf of our board of directors, it is our pleasure to invite you to attend the 2017 annual meeting of stockholders ofPure Storage, Inc., a Delaware corporation (Pure Storage). The meeting will be held virtually, via live webcast atwww.virtualshareholdermeeting.com/PSTG2017, originating from Mountain View, California, on Tuesday, June 20, 2017 at 10:00 a.m. Pacific Time, for the following purposes:

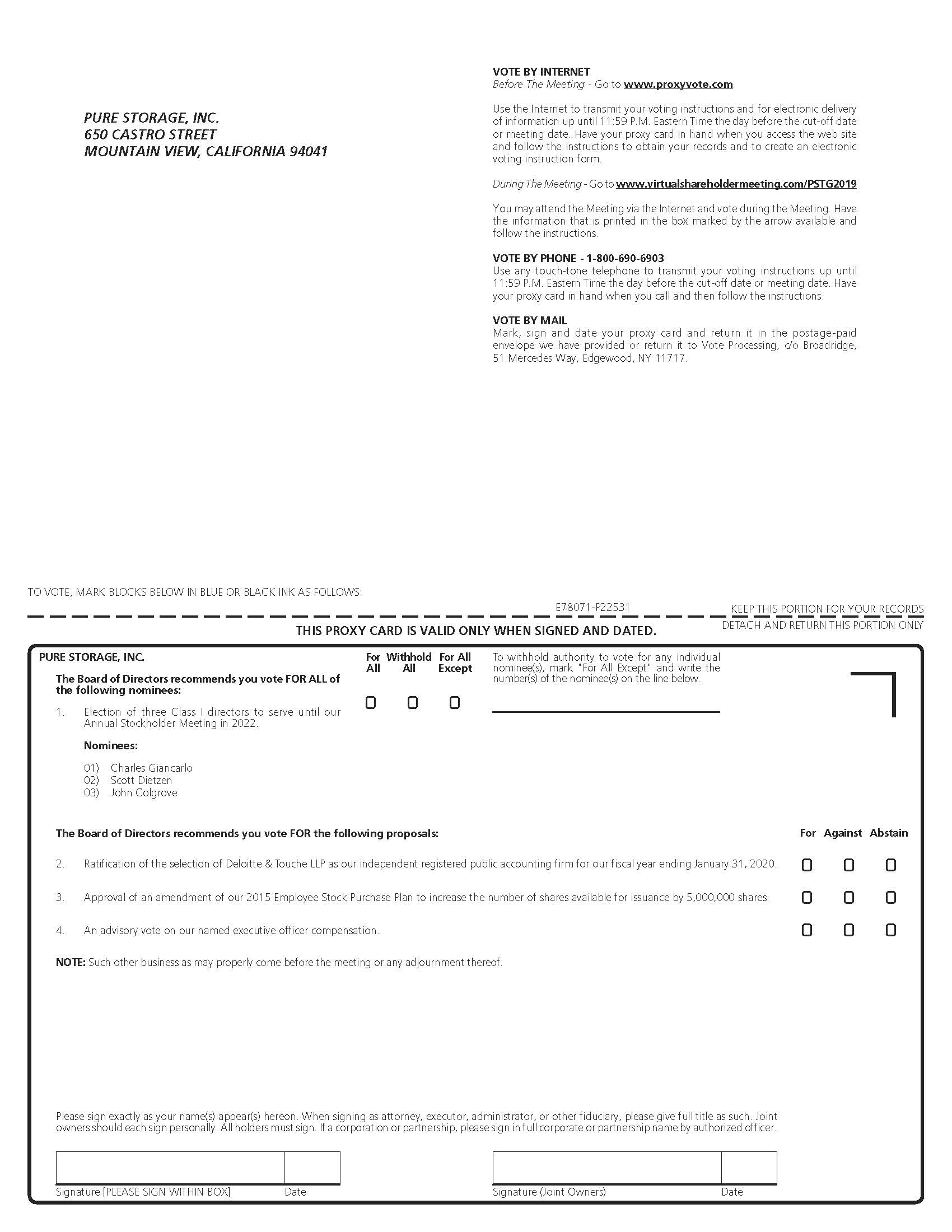

PROPOSAL 1:To elect three Class |

director nominee | |

PROPOSAL 2:To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending January 31, |

PROPOSAL 3:To |

PROPOSAL 4:To consider an advisory vote on the |

|

To conduct any other business properly brought before the meeting. | FOR |

The record date for

|

| You are cordially invited to attend the virtual annual meeting. Whether you expect to attend the meeting, you are urged to vote and submit your proxy by following the procedures described in the proxy card. Even if you have voted by proxy, you may still vote during the meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote during the meeting, you must follow the instructions from such agent. |

| 2019 PROXY STATEMENT | 3 | |

| 4 |  | |

PROPOSAL 1: ELECTION OF CLASS I DIRECTORS | |

| Charles Giancarlo, John Colgrove and Scott Dietzen have been nominated for election as Class I directors. Our board of directors and nominating and corporate governance committee believe that the director nominees possess the necessary qualifications to provide effective oversight of the | |

The board of directors recommends a vote FOReach nominee |  |

| |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| Our board of directors and audit committee believe that the continued retention of Deloitte & Touche LLP for the fiscal year ending January 31, 2020 is in the best interests of our company and its stockholders. As a matter of good corporate governance, our board of directors is asking stockholders to ratify the audit committee’s selection of the independent registered public accounting firm. | |

The board of directors recommends a vote FORthis proposal |  |

Mountain View, California

May 8, 2017

You are cordially invited to attend the virtual annual meeting. Whether you expect to attend the meeting, you are urged to vote and submit your proxy by following the procedures described in the proxy card. Even if you have voted by proxy, you may still vote during the meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote during the meeting, you must follow the instructions from such agent.

PROPOSAL 3: APPROVE AN AMENDMENT TO OUR 2015 EMPLOYEE STOCK PURCHASE PLAN | |

| Our board of directors and compensation committee believe it is in the best interests of our company to increase the number of shares reserved for issuance under the 2015 Employee Stock Purchase Plan by 5,000,000 shares. | |

The board of directors recommends a vote FORthis proposal |  |

PROPOSAL 4: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |

| Our executive compensation program is designed to promote long-term stockholder value creation and support our strategy by encouraging growth while prudently managing profitability and risk, attracting and retaining key talent, and appropriately aligning pay with performance. | |

The board of directors recommends a vote FORthis proposal |  |

| 2019 PROXY STATEMENT | 5 | |

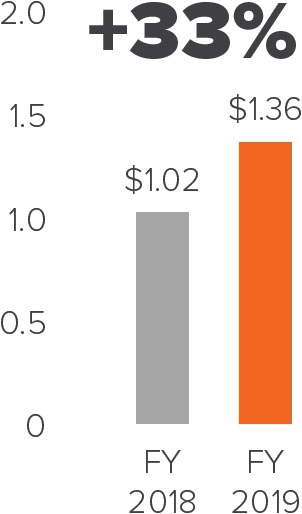

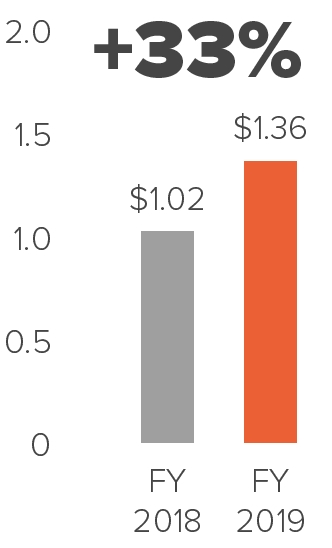

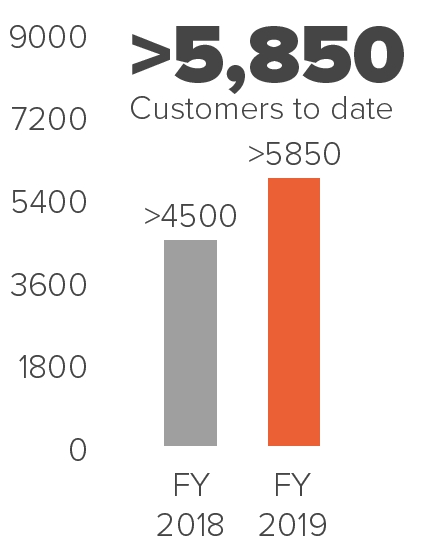

FISCAL 2019 BUSINESS AND FINANCIAL HIGHLIGHTSWe made excellent progress on our key company initiatives in our fiscal year ended January 31, 2019 (fiscal 2019). We invested in key markets and growth areas: the Global 2000, Cloud 1000, and next-generation analytics and AI. We now provide hybrid-cloud offerings, solutions for rapid restore, and over 80% of our system capacity now ships as NVMe. With our leading software and business model, we continued to deliver industry-leading customer delight, as evidenced by our Net Promoter Score of 86.6.REVENUES ADDITIONAL HIGHLIGHTS (in billions) ü We maintained our industry-leading gross product margins.ü We grew our international revenue from 26% of revenue in fiscal 2018 to 28% of revenue in fiscal 2019.ü We exceeded our operating margin guidance for the full year.ü We increased our total customer count to over 5,800, up from 4,500 a year prior, an increase of 30% year over year.ü We continued our industry-leading delivery of important new products opening up new markets. As we look ahead to our fiscal year ended January 31, 2020 (fiscal 2020) and beyond, we are excited about Pure Storage's market-leading momentum. We will continue to invest in the strategy we outlined last year.Our new product and service offerings have positioned Pure strategically in front of four major growth trends reshaping our industry and growing in importance for CIOs: hybrid cloud, fast, consolidated data architectures, AI and analytics, and the transition from slow data backup to rapid restore. Considering all of our new offerings, we believe our addressable market has grown substantially, by our estimates from $35 billion to $50 billion.As we embark on fiscal 2020, we are focused on continued industry-leading growth, expansion of our solutions, and advancing what makes Pure great: unrelenting innovation and a laser focus on customer delight.

As we look ahead to our fiscal year ended January 31, 2020 (fiscal 2020) and beyond, we are excited about Pure Storage's market-leading momentum. We will continue to invest in the strategy we outlined last year.Our new product and service offerings have positioned Pure strategically in front of four major growth trends reshaping our industry and growing in importance for CIOs: hybrid cloud, fast, consolidated data architectures, AI and analytics, and the transition from slow data backup to rapid restore. Considering all of our new offerings, we believe our addressable market has grown substantially, by our estimates from $35 billion to $50 billion.As we embark on fiscal 2020, we are focused on continued industry-leading growth, expansion of our solutions, and advancing what makes Pure great: unrelenting innovation and a laser focus on customer delight.6  PROXY STATEMENT SUMMARYCORPORATE GOVERNANCE HIGHLIGHTSBOARD COMPOSITION SNAPSHOTDirector tenure as of May 8, 2019:

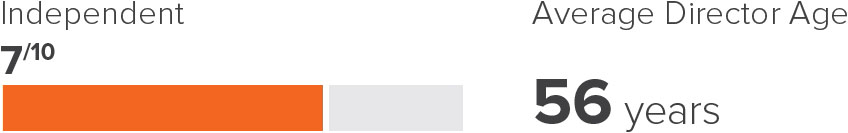

PROXY STATEMENT SUMMARYCORPORATE GOVERNANCE HIGHLIGHTSBOARD COMPOSITION SNAPSHOTDirector tenure as of May 8, 2019:DIRECTOR TENURE

GENDER DIVERSITY INDEPENDENCE

BOARD MEMBERSThe following table provides summary information about each director nominee and other directors as of May 8, 2019.

BOARD MEMBERSThe following table provides summary information about each director nominee and other directors as of May 8, 2019. Board Committees Name Class Age Independent Director

SinceAudit Compensation Nominating

and Corporate

Governance2019 Director Nominees Charles Giancarlo

Chairman and Chief Executive OfficerI 61 No 2017 Scott Dietzen

Vice Chairman and Former CEO, Pure StorageI 56 No 2010 John “Coz” Colgrove

Chief Technology Officer, Pure StorageI 56 No 2009 Continuing Directors Roxanne Taylor

Former Chief Marketing and Communications Officer, AccentureII 62 Yes 2019 Susan Taylor

Chief Accounting Officer, FacebookIII 50 Yes 2018

Mike Speiser

Managing Director, Sutter Hill VenturesII 48 Yes 2009 Mark Garrett

Former Chief Financial Officer, Adobe SystemsII 61 Yes 2015

Anita Sands

Former Group Managing Director andHead of Change Leadership, UBS Financial ServicesIII 42 Yes 2015

Frank Slootman

Frank Slootman

Chief Executive Officer, Snowflake andFormer CEO, ServiceNowII 60 Yes 2014

Jeff Rothschild

Advisor and Venture Partner, Accel PartnersIII 64 Yes 2018

Chair

2Member

Member/Financial Expert

Chair/Financial Expert 8Proposal 2 – Ratification of Selection of Independent Registered Public Accounting Firm1315Proposal 4 – Frequency of Advisory Vote on Executive Compensation16172936415859A-12019 PROXY STATEMENT 7 PROXY STATEMENT SUMMARYEXECUTIVE COMPENSATION HIGHLIGHTSAt the beginning of fiscal 2019, our compensation committee approved compensation packages for our executive officers that continued to shift compensation toward a “pay for performance” philosophy. Fiscal 2019 bonus awards transitioned from reliance on a quarterly revenue metric to annual revenue and profit metrics, and fiscal 2019 equity awards became entirely dependent on an annual revenue metric, shifting from half time-based and half performance-based awards in fiscal 2018, to 100% performance-based awards in fiscal 2019. These equity awards are further subject to time-based vesting over a multi-year period. Details of these awards and the performance metrics are discussed in detail in the section titled “Compensation Discussion and Analysis” below.OUR EXECUTIVE COMPENSATION PRACTICESOur executive compensation policies and practices reinforce our “pay for performance” philosophy and ensure that compensation is meaningfully tied to the creation of long-term stockholder value. Listed below are highlights of our fiscal 2019 compensation policies and practices:

Pure Storage, Inc.WHAT WE DO

WHAT WE DON’T DO• Performance-based cash and equity incentives• Caps on performance-based cash and equity incentive compensation• 100% independent directors on our compensation committee• Independent compensation consultant engaged by our compensation committee• Annual review and approval of our compensation strategy• Significant portion of executive compensation based on corporate metrics• Three-year equity award vesting period in addition to performance requirements• Limited and modest perquisites• No “single trigger” change of control payments or benefits• No post-termination retirement or pension-type non-cash benefits• No perquisites other than those available to our employees generally• No tax gross-ups for change of control payments or benefitsOUR FISCAL 2019 EXECUTIVE OFFICER PAYThe charts below show the pay mix of our CEO and other named executive officers and the components of their pay for fiscal 2019 (based on the values reported in the Summary Compensation Table). These charts illustrate the predominance of at-risk and performance-based components in our regular executive compensation program. We believe these components provide a compensation package that helps attract and retain qualified individuals, focuses the efforts of our executive officers on the achievement of both our short-term and long-term objectives and aligns the interests of our executive officers with those of our stockholders.

WHAT WE DON’T DO• Performance-based cash and equity incentives• Caps on performance-based cash and equity incentive compensation• 100% independent directors on our compensation committee• Independent compensation consultant engaged by our compensation committee• Annual review and approval of our compensation strategy• Significant portion of executive compensation based on corporate metrics• Three-year equity award vesting period in addition to performance requirements• Limited and modest perquisites• No “single trigger” change of control payments or benefits• No post-termination retirement or pension-type non-cash benefits• No perquisites other than those available to our employees generally• No tax gross-ups for change of control payments or benefitsOUR FISCAL 2019 EXECUTIVE OFFICER PAYThe charts below show the pay mix of our CEO and other named executive officers and the components of their pay for fiscal 2019 (based on the values reported in the Summary Compensation Table). These charts illustrate the predominance of at-risk and performance-based components in our regular executive compensation program. We believe these components provide a compensation package that helps attract and retain qualified individuals, focuses the efforts of our executive officers on the achievement of both our short-term and long-term objectives and aligns the interests of our executive officers with those of our stockholders.CEO

Average of All Other NEOs

8  TABLE OF CONTENTS

TABLE OF CONTENTS 2019 PROXY STATEMENT 9  650 Castro Street

650 Castro Street Suite 400

Mountain View, California 94041Proxy StatementPROXY STATEMENTFor the 20172019 Annual Meeting of Stockholders

To Be Held On June 20, 20172019 at 10:00 a.m. PTOur board of directors is soliciting your proxy to vote at the 20172019 annual meeting of stockholders of Pure Storage, Inc.,a Delaware corporation (Pure Storage), to be held virtually, via live webcast atwww.virtualshareholdermeeting.com/PSTG2017,PSTG2019, originating from Mountain View, California, on Thursday, June 20, 20172019 at 10:00 a.m. Pacific Time, and any adjournment or postponement thereof.For the meeting, we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form10-K, to our stockholders primarily via the internet. Beginning on or about May 8, 2017,2019, we mailed to our stockholders aNotice of Internet Availability of Proxy Materials (theNotice) that contains notice of the meeting and instructions on how to access our proxy materials on the internet, how to vote at the meeting, and how to request printed copies of the proxy materials. Stockholders may request to receive all future materials in printed form by mail or electronically bye-mail by following the instructions contained in the Notice. A stockholder’s election to receive proxy materials by mail or email will remain in effect until revoked. We encourage stockholders to take advantage of the availability of the proxy materials on the internet to help reduce the environmental impact and cost of our annual meetings.Only stockholders of record at the close of business on April 25, 20172019 will be entitled to vote at the meeting. On this record date, there were 93,051,400252,830,075 shares of Class A common stock and 114,863,423 shares of Class B common stock outstanding and entitled to vote (common stock)(common stock). Each holder of Class A common stock will have the right to one vote per shareshare. During fiscal 2019 (as defined below), all shares of our Class B common stock converted into Class A common stock and all of our stockholders now have one vote for each holder of Class B common stock will have the right to ten votes per share of Class B common stock. The holders of shares of common stock will vote together as a single class on all matters submitted to a vote at the meeting.held. A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours for ten days before the meeting at our address above. The stockholder list will also be available online during the meeting. If you plan to attend the meeting online, please see the instructions on page 2 ofelsewhere in this proxy statement.In this proxy statement, we refer to Pure Storage, Inc. as “Pure Storage,” “we” or “us” and the board of directors of Pure Storage as “our board of directors.” Pure Storage’s Annual Report on Form10-K, which contains consolidated financial statements as of and for the year ended January 31, 2017,2019 (fiscal 2019), accompanies this proxy statement. You also may obtain a copy of Pure Storage’s Annual Report on Form10-K for fiscal year 20172019 that was filed with the Securities and Exchange Commission (SEC), without charge, by writing to our Secretary at our address above.10  PROPOSAL 1

PROPOSAL 1

ELECTION OF DIRECTORSOur board of directors recommends a vote FOR all Class I director nominees. Our board of directors consists of ten members. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following the election. Our directors are divided into the three classes. Any directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.Dr. Dietzen and Messrs. Colgrove and Giancarlo are currently directors of Pure Storage and have been nominated to continue to serve as Class I directors. Each of these nominees has agreed to stand for reelection at the meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the meeting, each of these nominees would serve until the annual meeting of stockholders to be held in 2022 and until his successor has been duly elected, or if sooner, until the director’s death, resignation or removal.Our nominating and corporate governance committee seeks to assemble a board of directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the committee has identified and evaluated nominees in the broader context of our board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities deemed critical to effective functioning of our board of directors. Each of the nominees is currently a director.VOTE REQUIREDDirectors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by us.DIRECTOR NOMINATION AND BOARD REFRESHMENT PROCESSIn evaluating candidates for our Board, our nominating and corporate governance committee considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the company, having the ability to read and understand basic financial statements, demonstrated commitment to the highest personal integrity and ethics, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of Pure Storage’s stockholders. These qualifications may be modified from time to time. The committee also considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of our board of directors and the company, to maintain a balance of knowledge, experience and capability. The committee takes into account the current composition of our board of directors, the operating requirements of the company and the long-term interests of stockholders.In the case of incumbent directors whose terms of office are set to expire, our nominating and corporate governance committee will review directors’ prior service to Pure Storage, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, our nominating and corporate governance committee also evaluates whether the nominee is independent for NYSE purposes, based upon applicable NYSE listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. Our nominating and corporate governance committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our board of directors. Our nominating and corporate governance committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to our board of directors.

Our board of directors consists of ten members. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following the election. Our directors are divided into the three classes. Any directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.Dr. Dietzen and Messrs. Colgrove and Giancarlo are currently directors of Pure Storage and have been nominated to continue to serve as Class I directors. Each of these nominees has agreed to stand for reelection at the meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the meeting, each of these nominees would serve until the annual meeting of stockholders to be held in 2022 and until his successor has been duly elected, or if sooner, until the director’s death, resignation or removal.Our nominating and corporate governance committee seeks to assemble a board of directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the committee has identified and evaluated nominees in the broader context of our board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities deemed critical to effective functioning of our board of directors. Each of the nominees is currently a director.VOTE REQUIREDDirectors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by us.DIRECTOR NOMINATION AND BOARD REFRESHMENT PROCESSIn evaluating candidates for our Board, our nominating and corporate governance committee considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the company, having the ability to read and understand basic financial statements, demonstrated commitment to the highest personal integrity and ethics, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of Pure Storage’s stockholders. These qualifications may be modified from time to time. The committee also considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of our board of directors and the company, to maintain a balance of knowledge, experience and capability. The committee takes into account the current composition of our board of directors, the operating requirements of the company and the long-term interests of stockholders.In the case of incumbent directors whose terms of office are set to expire, our nominating and corporate governance committee will review directors’ prior service to Pure Storage, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, our nominating and corporate governance committee also evaluates whether the nominee is independent for NYSE purposes, based upon applicable NYSE listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. Our nominating and corporate governance committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our board of directors. Our nominating and corporate governance committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to our board of directors.2019 PROXY STATEMENT 11 PROPOSAL 1 ELECTION OF DIRECTORSOur nominating and corporate governance committee intends to evaluate director candidates recommended by stockholders based on the factors and qualifications discussed above, though it has not implemented a formal policy regarding such process. The committee may implement a formal policy regarding consideration of director candidates recommended by stockholders in the future.Below is a summary of the primary skills, experience and qualifications that our directors bring to our board of directors:Executive leadershipTechnology expertiseSales and marketing experienceFinance and accounting expertiseOperational experienceExperience in the Enterprise IT industryOur board of directors believes that rotation of directors is integral to an effective governance structure. Moreover, rotation brings diverse viewpoints and new perspectives, a variety of skills and professional experiences, which are important components of governance and promoting the long-term interests of stockholders. In identifying board candidates, our board of directors seeks candidates with diverse backgrounds, and believes that a greater breadth of personal and professional experience improves the quality of decision making and enhances business performance. Our board of directors has a balance of new and continuing directors, with average tenure of approximately 4.4 years as of May 8, 2019. Since the start of fiscal 2019, we appointed three new independent directors, including two women.NOMINEES FOR ELECTION UNTIL THE 2022 ANNUAL MEETING OF STOCKHOLDERS CHARLES GIANCARLO ChairmanChairman and Chief Executive OfficerAge:

CHARLES GIANCARLO ChairmanChairman and Chief Executive OfficerAge:

61Director Since:

August 2017Committee:

NoneBACKGROUNDMr. Giancarlo has served as our Chief Executive Officer since August 2017, and as our Chairman since September 2018. Mr. Giancarlo previously served as Managing Director, Head of Value Creation and later Senior Advisor at Silver Lake Partners, a private investment firm, from 2007 to 2015, where he focused on investment and business improvement opportunities for Silver Lake’s portfolio companies. From 2008 to 2009, Mr. Giancarlo served as Interim President and CEO of Avaya. Prior to that, from 1993 to 2007, Mr. Giancarlo served in senior executive roles at Cisco Systems, including Chief Technology Officer and Chief Development Officer and is credited with introducing many new technologies including Ethernet Switching, WiFi, IP Telephony and Telepresence. Mr. Giancarlo currently serves on the boards of directors of Arista Networks, Inc. and zScaler, Inc. Mr. Giancarlo previously served on the boards of directors of Accenture plc, Netflix, ServiceNow, Avaya, Imperva and Tintri. Mr. Giancarlo received a B.S. in Engineering from Brown University, a M.S. in Electrical Engineering from the University of California, Berkeley, and an M.B.A. from Harvard Business School.QUALIFICATIONS FOR BOARD SERVICEMr. Giancarlo’s qualifications for board service include his extensive executive leadership and operational experience, as well as his relevant industry knowledge.12  PROPOSAL 1 ELECTION OF DIRECTORS

PROPOSAL 1 ELECTION OF DIRECTORS

JOHN “COZ” COLGROVE Founder, Chief Technology Officer and DirectorAge:

56Director Since:

October 2009Committee:

NoneBACKGROUNDMr. Colgrove has served as our Chief Technology Officer and as a member of our board of directors since founding Pure Storage in October 2009. In 2009, Mr. Colgrove served as an Entrepreneur in Residence at Sutter Hill Ventures, a venture capital firm. From 2005 to 2008, Mr. Colgrove served as a Fellow and Chief Technology Officer for the Datacenter Management Group of Symantec. Mr. Colgrove was one of the founding engineers and a Fellow at Veritas Software Corp., a provider of storage management solutions, which merged with Symantec in 2005. Mr. Colgrove earned his B.S. in Computer Science from Rutgers University and holds over 150 patents in the areas of system, data storage and software design.QUALIFICATIONS FOR BOARD SERVICEMr. Colgrove’s qualifications for board service include his industry knowledge and his experience as a founder of Pure Storage, as well as his leadership experience and deep technical expertise.

SCOTT DIETZEN Vice Chairman and DirectorAge:

56Director Since:

October 2010Committee:

NoneBACKGROUNDDr. Dietzen has served as our Vice Chairman since September 2018. Dr. Dietzen previously served as our Chief Executive Officer from October 2010 to August 2017, and as our Chairman from August 2017 to September 2018. From 2007 to 2009, Dr. Dietzen served in various roles at Yahoo! Inc., an internet technology company, including as interim Senior Vice President of Yahoo! Communications and Communities. From 2005 to 2007, Dr. Dietzen served as President and Chief Technology Officer of Zimbra, Inc., a provider of open source messaging and collaboration software until its sale to Yahoo! in 2007. From 1998 to 2004, Dr. Dietzen served in various roles at BEA Systems, Inc., including as BEA Systems’ Chief Technology Officer. He had served as Vice President, Marketing at WebLogic, Inc., a provider of web application servers, which BEA Systems acquired in 1998. Dr. Dietzen previously served as Principal Technologist at Transarc Corporation, a filesystem software company that was acquired by IBM. He earned a B.S. in Applied Mathematics and Computer Science and a M.S. and Ph.D. in Computer Science from Carnegie Mellon University.QUALIFICATIONS FOR BOARD SERVICEDr. Dietzen’s qualifications for board service include his deep technology background and his extensive leadership experience across a range of technology companies.2019 PROXY STATEMENT 13 PROPOSAL 1 ELECTION OF DIRECTORSCLASS II DIRECTORS CONTINUING IN OFFICE UNTIL THE 2020 ANNUAL MEETING OF STOCKHOLDERS MARK GARRETT IndependentFormer Chief Financial Officer, Adobe SystemsAge:

MARK GARRETT IndependentFormer Chief Financial Officer, Adobe SystemsAge:

61Director Since:

July 2015Committee:

Audit Committee (Chair)BACKGROUNDFrom February 2007 to April 2018, Mr. Garrett served as Executive Vice President and Chief Financial Officer of Adobe Systems Incorporated, a producer of creative and digital marketing software. From 2004 to 2007, Mr. Garrett served as Senior Vice President and Chief Financial Officer of the Software Group of EMC Corporation, an information technology company. From 2002 to 2004 and from 1997 to 1999, Mr. Garrett served as Executive Vice President and Chief Financial Officer of Documentum, Inc., including throughout its acquisition by EMC in December 2003. Mr. Garrett currently serves on the board of directors of Cisco Systems, Inc. and GoDaddy, Inc. Mr. Garrett previously served on the boards of directors of Model N, Inc. from 2008 to 2016 and Informatica Corporation from 2008 to 2015. Mr. Garrett earned a B.S. in accounting and marketing from Boston University and an M.B.A. from Marist College.QUALIFICATIONS FOR BOARD SERVICEMr. Garrett’s qualifications for board service include his extensive management and financial experience, as well as his relevant industry knowledge. MIKE SPEISER IndependentManaging Director, Sutter Hill VenturesAge:

MIKE SPEISER IndependentManaging Director, Sutter Hill VenturesAge:

48Director Since:

October 2009Committee:

NoneBACKGROUNDSince 2008, Mr. Speiser has served as a Managing Director at Sutter Hill Ventures, a venture capital firm. From 2007 to 2008, Mr. Speiser served as Vice President of Community Products at Yahoo! Inc. From 2006 to 2007, Mr. Speiser served as President and Chief Executive Officer of Bix, Inc., an internet company that Mr. Speiser founded. From 2005 to 2006, Mr. Speiser served as a technical advisor to Symantec. From 2001 to 2005, Mr. Speiser served as Vice President of Product Management and Product Marketing at Veritas Software. Mr. Speiser earned a B.A. in Political Science from the University of Arizona and an M.B.A. from Harvard Business School.QUALIFICATIONS FOR BOARD SERVICEMr. Speiser’s qualifications for board service include his early and active involvement with Pure Storage and his extensive leadership and operational experience, as well as his perspective as a venture investor.14  PROPOSAL 1 ELECTION OF DIRECTORS

PROPOSAL 1 ELECTION OF DIRECTORS FRANK SLOOTMAN IndependentChief Executive Officer, Snowflake and Former Chief Executive Officer, ServiceNowAge:

FRANK SLOOTMAN IndependentChief Executive Officer, Snowflake and Former Chief Executive Officer, ServiceNowAge:

60Director Since:

May 2014Committee:

Compensation Committee (Chair)BACKGROUNDMr. Slootman currently serves as the Chief Executive Officer, Snowflake Inc., a cloud data warehouse company. From October 2016 to June 2018, Mr. Slootman served as the Chairman of ServiceNow, Inc., an enterprise IT cloud company. From May 2011 to April 2017, Mr. Slootman served as President and Chief Executive Officer and as a member of the board of directors of ServiceNow. From January 2011 to April 2011, Mr. Slootman served as a Partner with Greylock Partners, a venture capital firm. From 2011 to 2012, Mr. Slootman served as an advisor to EMC Corporation. From 2009 to 2011, Mr. Slootman served as President of the Backup Recovery Systems Division at EMC. From 2003 to 2009, Mr. Slootman served as President and Chief Executive Officer of Data Domain Corporation, an information technology company, which was acquired by EMC in 2009. Mr. Slootman served as a member of the board of directors of Imperva, Inc. from 2011 to 2016. Mr. Slootman earned undergraduate and graduate degrees in Economics from the Netherlands School of Economics, Erasmus University Rotterdam.QUALIFICATIONS FOR BOARD SERVICEMr. Slootman’s qualifications for board service include his extensive leadership and operational experience, as well as his relevant industry knowledge. ROXANNE TAYLOR IndependentFormer Chief Marketing and Communications Officer, AccentureAge:

ROXANNE TAYLOR IndependentFormer Chief Marketing and Communications Officer, AccentureAge:

62Director Since:

February 2019Committee:

NoneBACKGROUNDFrom 2007 until December 2017, Ms. Taylor served as Chief Marketing and Communications Officer at Accenture, a global professional services company. From 1995 to 2007, Ms. Taylor served in various marketing positions at Accenture including managing director corporate and financial communications and director of marketing & communications for the Financial Services practice. Before joining Accenture, Ms. Taylor served in corporate communications, investor relations, and senior marketing positions at Reuters and Citicorp/Quotron from 1993 to 1995 and 1989 to 1993, respectively. Ms. Taylor received a B.A. in Psychology from University of Maryland, College Park.QUALIFICATIONS FOR BOARD SERVICEMs. Taylor’s qualifications for board service include her extensive marketing experience, as well as her technology industry knowledge.2019 PROXY STATEMENT 15 PROPOSAL 1 ELECTION OF DIRECTORSCLASS III DIRECTORS CONTINUING IN OFFICE UNTIL THE 2021 ANNUAL MEETING OF STOCKHOLDERS JEFF ROTHSCHILD IndependentAdvisor and Venture Partner, Accel PartnersAge:

JEFF ROTHSCHILD IndependentAdvisor and Venture Partner, Accel PartnersAge:

64Director Since:

March 2018Committees:

Nominating and Corporate Governance CommitteeBACKGROUNDSince 1999, Mr. Rothschild has served as an Advisor and Venture Partner at Accel Partners. Mr. Rothschild was the VP of Infrastructure Engineering at Facebook from 2005 to 2015. Mr. Rothschild previously co-founded Veritas Software Corp., a provider of storage management solutions, where his role included product strategy, sales and marketing. Prior to Veritas, Mr. Rothschild worked with a number of companies in the areas of storage management, system software and networking. Mr. Rothschild is the Vice-Chairman of The Vanderbilt University Board of Trustees. Mr. Rothschild holds an M.S. in Computer Science and a B.A. in Psychology from Vanderbilt University.QUALIFICATIONS FOR BOARD SERVICEMr. Rothschild’s qualifications for board service include his extensive technical and executive leadership and operational experience, as well as his relevant infrastructure knowledge and customer perspective. ANITA SANDS IndependentFormer Group Managing Director and Head of Change Leadership, UBS Financial ServicesAge:

ANITA SANDS IndependentFormer Group Managing Director and Head of Change Leadership, UBS Financial ServicesAge:

42Director Since:

July 2015Committees:

Audit Committee, Nominating and Corporate Governance Committee (Chair)BACKGROUNDFrom 2012 to 2013, Dr. Sands served as Group Managing Director and Head of Change Leadership and a member of the Wealth Management Americas Executive Committee of UBS Financial Services, a global financial services firm. From 2010 to 2012, Dr. Sands served as Group Managing Director and Chief Operating Officer of Wealth Management Americas at UBS Financial Services. From 2009 to 2010, Dr. Sands served as Transformation Consultant at UBS Financial Services. From 2008 to 2009, Dr. Sands served as Managing Director, Head of Transformation Management at Citigroup’s Global Operations and Technology organization. Prior to that, Dr. Sands also held several leadership positions with RBC Financial Group and CIBC. Dr. Sands currently serves on the board of directors of Symantec and ServiceNow, Inc. Dr. Sands earned a B.S. in Physics and Applied Mathematics from The Queen’s University of Belfast, Northern Ireland, a Ph.D. in Atomic and Molecular Physics from The Queen’s University of Belfast, Northern Ireland and a M.S. in Public Policy and Management from Carnegie Mellon University.QUALIFICATIONS FOR BOARD SERVICEDr. Sands’ qualifications for board service include her extensive leadership and operational experience at global financial services firms, as well as her service as a director of multiple large technology companies.16  PROPOSAL 1 ELECTION OF DIRECTORS

PROPOSAL 1 ELECTION OF DIRECTORS SUSAN TAYLOR IndependentChief Accounting Officer, FacebookAge:

SUSAN TAYLOR IndependentChief Accounting Officer, FacebookAge:

50Director Since:

October 2018Committees:

Audit Committee, Compensation CommitteeBACKGROUNDSince April 2017, Ms. Taylor has served as Chief Accounting Officer of Facebook, Inc. From January 2012 to March 2017, Ms. Taylor served as Vice President, Controller, and Chief Accounting Officer of LinkedIn Corporation, a professional social networking company. From 2009 to 2012, Ms. Taylor served as the Vice President, Controller, and Chief Accounting Officer of Silver Spring Networks, Inc., a provider of networking solutions, and from 2008 to 2009, Ms. Taylor served as the Senior Director, Accounting Policy of Yahoo! Inc. Prior to Yahoo!, Ms. Taylor spent over thirteen years at PricewaterhouseCoopers LLP, an accounting firm, in various accounting roles. Ms. Taylor received a bachelor of commerce degree from the University of Toronto, and is a Certified Public Accountant (inactive) in California.QUALIFICATIONS FOR BOARD SERVICEMs. Taylor’s qualifications for board service include her extensive management and financial experience, as well as her technology industry knowledge and operational experience.BOARD OF DIRECTORS ROLE AND RESPONSIBILITIESRISK OVERSIGHTOur board of directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, improve long-term organizational performance, and enhance stockholder value. A fundamental part of risk management is not only understanding the most significant risks a company faces and what steps management is taking to manage those risks but also understanding what level of risk is appropriate for a given company. The involvement of our full board of directors in reviewing our business is an integral aspect of its assessment of management’s tolerance for risk and also its determination of what constitutes an appropriate level of risk.Our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our audit committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function.Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct.At periodic meetings of our board of directors and its committees, management reports to and seeks guidance from our board and its committees with respect to the most significant risks that could affect our business, such as legal, cyber-security, financial, tax and audit related risks. In addition, among other matters, management provides our audit committee periodic reports on our compliance programs and investment policy and practices.2019 PROXY STATEMENT 17 PROPOSAL 1 ELECTION OF DIRECTORSCOMPENSATION RISK ASSESSMENTOur compensation committee assesses and monitors whether any of our compensation policies, practices and programs has the potential to encourage excessive risk-taking. Based on that review, we have concluded that our compensation programs do not create risks that are reasonably likely to have a material adverse effect on our company for the following reasons:Our equity awards for senior executive officers have both performance vesting criteria, as well as time-based vesting criteria, which balances competing short-term and long-term incentives;Our equity awards are full value awards and are granted on an annual basis with long-term, overlapping vesting periods to motivate recipients to focus on sustained stock price appreciation;Our performance equity and bonus awards contain a cap on maximum payout;Our compensation committee has retained an independent compensation consultant to provide objective advice on matters related to the compensation of our executive officers and non-employee directors, including best practices and governance issues; andOur compensation committee annually reviews competitive benchmarking data in setting pay mix, targets and long-term incentive elements for our executive officers’ packages.HUMAN CAPITAL MANAGEMENTOur success depends on our ability to attract, retain and develop talented and skilled employees. We believe that diversity drives innovation. In building and managing our workforce, we seek to invest in creating a diverse and inclusive environment where everyone can bring their whole self to the workplace. These efforts include:Building Pure Storage's global talent brand as an employer of choice for diverse, innovative talent through external channels and by creating an aligned internal employee experience.Investing significant resources to develop the talent needed to keep Pure at the forefront of innovation, including a number of web-based and in-person training initiatives.Ensuring that employees understand how their work contributes to the company’s overall goals and strategy. We use a variety of communications channels to facilitate open and direct communication, including open town-hall forums with our executives, and annual employee voice surveys to identify strengths and opportunities for improvement.Engagement through employee resource groups including women, LGBTQ+, veterans, and individuals with differing abilities.We also invest in the well-being of our employees through a comprehensive compensation and benefits strategy that includes competitive salary, annual incentive awards for nearly all employees, generous paid time off, and other benefits to promote financial, physical and emotional well-being.CORPORATE RESPONSIBILITY AND CITIZENSHIPCOMPLIANCE AND ETHICSWe pride ourselves on our culture and our company values. We strive to embody these values in everything we do. Just as important are our underlying common principles of Integrity, Honesty and Respect for Others—these truly define Pure and are at the heart of our code of conduct, which applies to all of our directors, officers and employees. Our code of conduct goes beyond merely fulfilling legal requirements—at Pure, conduct counts. All of our employees are required to complete training courses on our code of conduct. In addition, we conduct mandatory trainings to address compliance risks associated with specific roles in our company. We plan to disclose future amendments to certain provisions of our code of conduct, or waivers of such provisions applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and our directors, on our website.Our board of directors has also adopted a set of guidelines that establish the corporate governance policies pursuant to which our board of directors intends to conduct its oversight of the business of Pure Storage in accordance with its fiduciary responsibilities.Our code of conduct, applicable waivers thereof, and our corporate governance guidelines are available in the “Corporate Governance” section of our investor relations website at investor.purestorage.com.18  PROPOSAL 1 ELECTION OF DIRECTORSPURE GOOD FOUNDATIONThe Pure Good Foundation (Pure Good) was established in 2015 with an employee-approved stock endowment to continue and deepen employee engagement in our communities around the world. The foundation operates with the mission to empower our employees and non-profit partners to build a better world through service, technology and engagement. To date, the foundation has funded initiatives such as Kaboom! playground builds in Redwood City and Chicago, and an annual 4-day bike ride in EMEA, raising funds for Action Medical Research.The foundation divides its philanthropic efforts across three areas:

PROPOSAL 1 ELECTION OF DIRECTORSPURE GOOD FOUNDATIONThe Pure Good Foundation (Pure Good) was established in 2015 with an employee-approved stock endowment to continue and deepen employee engagement in our communities around the world. The foundation operates with the mission to empower our employees and non-profit partners to build a better world through service, technology and engagement. To date, the foundation has funded initiatives such as Kaboom! playground builds in Redwood City and Chicago, and an annual 4-day bike ride in EMEA, raising funds for Action Medical Research.The foundation divides its philanthropic efforts across three areas:INVESTING IN INNOVATION 1.GLOBAL INTEREST GRANTSHANDS ON VOLUNTEERISM Innovation is a core value of Pure Storage, and by extension Pure Good invests in innovative solutions to pressing problems facing youth. Focused on our core value of teamwork, funding is provided to Pure Storage teams of five or more employees to support initiatives of their choosing and may include grants to fundraise for other organizations, undertake team building activities, or provide direct community assistance. Pure Good matches Pure Storage | 2017 Proxy Statementemployees with youth-based organizations that are local to where they live and work across the globe. Matches are made between needs identified by these organizations and the appropriate skill set of Pure employees.Pure Good’s fiscal 2019 highlights include:Raising $200,000 from employees to support Kidspire programs in Vietnam. Kidspire used those funds to build out an Innovation Lab, creating a first-of-its’ kind educational space in Vietnam, giving 105 students in an orphanage access to technology and maker space. In addition, this program funded the new Lead VN program, which provides access to college and career opportunities for students who are aging out of orphanages. In addition to our financial contribution, a team of ten Pure Storage employees worked with Kidspire for two weeks to support this project. Funding and completing a Kaboom! playground build in North Chicago. By utilizing fundraising through our annual Golf4Good tournament, we worked directly with the North Chicago community to create and install a playground in the Manchester Knolls Housing Cooperative, serving 500 low-income residents and creating opportunity for healthy play and community building on their new playground. Partnered with Spark for three years, providing the opportunity for students to explore different career opportunities, build key skills, and access a window of possibilities that would not otherwise be available, mentor one-day tech overview for local low-income students, as well as provide a spring semester partnership with 1:1 mentors weekly at Pure Storage. HOUSING TRUST SILICON VALLEYAs a company headquartered in Silicon Valley, we believe we have a responsibility to help solve the challenge of affordable housing. In November 2018, we invested $5 million in the TECH Fund, a program started by Housing Trust Silicon Valley to help build affordable homes in the Bay Area. The fund’s goal is to create 10,000 affordable housing opportunities in its first 10 years, and has already started about 1,500 homes across fifteen developments in Silicon Valley, with more than half for families, a third for the homeless and/or permanent supportive housing, and one in five for seniors.PRODUCT AND SUPPLY CHAIN ACCOUNTABILITYWe work to ensure an ethical supply chain in the production of our industry-leading products. We are members of the Responsible Business Alliance, and abide by their principles and code of conduct. At Pure, we think about the effect on the planet of our products from production, to installation, to end of life. In all of our manufacturing operations, we ensure that we are complying with environmental regulations and recycling our product on a country by country basis, and our product organically empowers our customers through green technology that supports their energy sustainability goals.2019 PROXY STATEMENT 19

regulations of the SEC and the listing requirements and rules of the NYSE. Dr. Dietzen and Messrs. Colgrove and Giancarlo are not independent due to their status as our current or former executive officers. Election of three Class PROPOSAL 1 ELECTION OF DIRECTORSCOMMUNICATIONS WITH OUR BOARD OF DIRECTORSStockholders or interested parties who wish to communicate with our board of directors or with an individual director may do so by mail to our board of directors or the individual director, care of our Secretary at 650 Castro Street, Mountain View, California 94041. The communication should indicate that it contains a stockholder or interested party communication. All such communication will be forwarded to the director or directors to whom the communication is addressed. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the Chair of the Audit, Compensation, or Nominating and Corporate Governance Committee.BOARD STRUCTURE AND PROCESSESBOARD LEADERSHIPMr. Giancarlo serves as Chairman of our board of directors and AnswersAboutDr. Dietzen serves as Vice Chairman of our board of directors. Our board of directors does not have a lead independent director. Our board of directors believes that the current board leadership structure, coupled with a strong emphasis on board independence, provides effective independent oversight of management while allowing the board and management to benefit from the extensive executive leadership and operational experience of Mr. Giancarlo and Dr. Dietzen. Independent directors and management sometimes have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside of our company, while Dr. Dietzen and Messrs. Colgrove and Giancarlo bring company-specific experience and expertise.DIRECTOR INDEPENDENCEOur common stock is listed on the New York Stock Exchange (NYSE). Under the listing requirements and rules of the NYSE, independent directors must comprise a majority of our board of directors.Our board of directors has undertaken a review of its composition, the composition of its committees and the independence of each director. Our board of directors has determined that Dr. Sands and Mses. S. Taylor and R. Taylor, and Messrs. Garrett, Rothschild, Slootman, and Speiser, do not have any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these Proxy Materialsdirectors is “independent” as that term is defined under the applicable rules and VotingAccordingly, a majority of our directors are independent, as required under applicable NYSE rules. In making this determination, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence.EXECUTIVE SESSIONS OF INDEPENDENT DIRECTORSIn order to promote open discussion among non-management directors, and as required under applicable NYSE rules, our board of directors has a policy of conducting executive sessions of non-management directors during each regularly scheduled board meeting and at such other times if requested by a non-management director. The non-management directors provide feedback to executive management, as needed, promptly after the executive session. Neither Mr. Giancarlo nor Mr. Colgrove participates in such sessions. In addition, we hold executive sessions including only independent directors at least once a year. The presiding director at each executive session is chosen by the directors present at that meeting.BOARD COMMITTEESOur board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. Our board of directors may establish other committees to facilitate the management of our business. Copies of the charters of each committee are available in the “Corporate Governance” section of our investor relations website at investor.purestorage.com. Members serve on these committees until their resignation or until otherwise determined by our board of directors. The composition and functions of each committee are described below.20  PROPOSAL 1 ELECTION OF DIRECTORSAUDIT COMMITTEEMEETINGS IN FY 2019:4MEMBERS:Mr. Garrett (Chair)Dr. SandsMs. S. TaylorOur board of directors has determined that Mr. Garrett, Dr. Sands and Ms. S. Taylor are independent under NYSE listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended. Our board of directors has determined that Mr. Garrett and Ms. S. Taylor are each an “audit committee financial expert” within the meaning of SEC regulations. Our board of directors has also determined that each member of our audit committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, the board of directors has examined each audit committee member’s scope of experience and the nature of their prior or current employment.PRIMARY RESPONSIBILITIES:The primary purpose of the audit committee is to discharge the responsibilities of our board of directors with respect to our accounting, financial and other reporting and internal control practices, to oversee our independent registered accounting firm and to monitor for various business risks. Specific responsibilities of our audit committee include:• selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;• helping to ensure the independence and performance of our independent registered public accounting firm;• ��discussing the scope and results of the audit with our independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results;• developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;• reviewing risk assessments and steps relating to risk management, including cybersecurity and other business risks;• reviewing related party transactions;• obtaining and reviewing a report by our independent registered public accounting firm at least annually, that describes our internal quality control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and• approving (or, as permitted, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

PROPOSAL 1 ELECTION OF DIRECTORSAUDIT COMMITTEEMEETINGS IN FY 2019:4MEMBERS:Mr. Garrett (Chair)Dr. SandsMs. S. TaylorOur board of directors has determined that Mr. Garrett, Dr. Sands and Ms. S. Taylor are independent under NYSE listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended. Our board of directors has determined that Mr. Garrett and Ms. S. Taylor are each an “audit committee financial expert” within the meaning of SEC regulations. Our board of directors has also determined that each member of our audit committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, the board of directors has examined each audit committee member’s scope of experience and the nature of their prior or current employment.PRIMARY RESPONSIBILITIES:The primary purpose of the audit committee is to discharge the responsibilities of our board of directors with respect to our accounting, financial and other reporting and internal control practices, to oversee our independent registered accounting firm and to monitor for various business risks. Specific responsibilities of our audit committee include:• selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;• helping to ensure the independence and performance of our independent registered public accounting firm;• ��discussing the scope and results of the audit with our independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results;• developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;• reviewing risk assessments and steps relating to risk management, including cybersecurity and other business risks;• reviewing related party transactions;• obtaining and reviewing a report by our independent registered public accounting firm at least annually, that describes our internal quality control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and• approving (or, as permitted, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.2019 PROXY STATEMENT 21 PROPOSAL 1 ELECTION OF DIRECTORSCOMPENSATION COMMITTEEMEETINGS IN FY 2019:4MEMBERS:Mr. Slootman (Chair)Ms. TaylorOur board of directors has determined that Mr. Slootman and Ms. S. Taylor are independent under NYSE listing standards, and are “non-employee directors” as defined in Rule 16b-3 promulgated under the Exchange Act.PRIMARY RESPONSIBILITIES:The primary purpose of our compensation committee is to discharge the responsibilities of our board of directors to oversee our compensation policies, practices and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate. Specific responsibilities of our compensation committee include:• reviewing and approving, or recommending that our board of directors approve, the compensation of our executive officers;• reviewing and recommending to our board of directors the compensation of our directors;• reviewing and approving, or recommending that our board of directors approve, the terms of compensatory arrangements with our executive officers;• administering our stock and equity incentive plans;• selecting independent compensation consultants or other advisers and assessing whether there are any conflicts of interest with any of the committee’s compensation advisers;• reviewing and approving, or recommending that our board of directors approve, incentive compensation and equity plans, severance agreements, change-of-control protections and any other compensatory arrangements for our executive officers and other senior management, as appropriate; and• reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy.Under its charter, our compensation committee may form, and delegate authority to, subcommittees as appropriate. See the sections titled “Compensation Discussion and Analysis” and “Director Compensation” for a description of our processes and procedures for the consideration and determination of executive and director compensation.COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONNeither Mr. Slootman nor Ms. S. Taylor, the members of our compensation committee, is currently, or has been at any time, one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.22  PROPOSAL 1 ELECTION OF DIRECTORSNOMINATING AND CORPORATE GOVERNANCE COMMITTEEMEETINGS IN FY 2019:3MEMBERS:Dr. Sands (Chair)

PROPOSAL 1 ELECTION OF DIRECTORSNOMINATING AND CORPORATE GOVERNANCE COMMITTEEMEETINGS IN FY 2019:3MEMBERS:Dr. Sands (Chair)

Mr. RothschildEach member of the nominating and corporate governance committee is independent, is a non-employee director and is free from any relationship that would interfere with the exercise of his or her independent judgment, as determined by the board of directors in accordance with the applicable NYSE listing standards.PRIMARY RESPONSIBILITIES:Specific responsibilities of our nominating and corporate governance committee include:• identifying, evaluating and selecting, or recommending that our board of directors approve, nominees for election to our board of directors;• evaluating the performance of our board of directors and of individual directors;• considering and making recommendations to our board of directors regarding the composition of the committees of the board of directors;• reviewing developments in corporate governance practices;• evaluating the adequacy of our corporate governance practices and reporting;• reviewing management succession plans;• developing and making recommendations to our board of directors regarding corporate governance guidelines and matters; and• overseeing an annual evaluation of the board of directors’ performance.CORPORATE GOVERNANCE BEST PRACTICESWe are committed to maintain a set of robust corporate governance practices, as well as continuous improvement of those practices, in order to maintain and enhance independent oversight and align our governance with our strategic objectives. These practices include the following:ü During fiscal 2019, all shares of our Class B common stock converted into Class A common stock and all of our stockholders now have one vote for each share of common stock heldü We have increased the diversity of our board of directors. At the end of fiscal 2018, 11% of our board was composed of women. As of the date of this proxy statement, 30% of our board is composed of womenü All of our committees are composed entirely of independent directorsü Our board of directors is committed to periodic renewal and rotation. Since the start of fiscal 2019, we increased the size of our board of directors from 9 to 10 members and added three new directors, including two additional female independent directorsü Independent directors meet in executive session without management present at each regularly scheduled meeting of the board of directorsü With the addition of 3 new directors in fiscal 2019, we reduced the average board tenure from 5.0 years as of January 31, 2018 to 4.64 years as of January 31, 2019ü7 of 10 directors are independent2019 PROXY STATEMENT 23 PROPOSAL 1 ELECTION OF DIRECTORSBOARD AND COMMITTEE MEETINGS AND ATTENDANCEOur board of directors is responsible for the oversight of management and the strategy of our company and for establishing corporate policies. Our board of directors meets periodically during the year to review significant developments affecting us and to act on matters requiring the approval of our board of directors. Our board of directors met five times during our last fiscal year. The audit committee met four times during our last fiscal year. The compensation committee met four times during our last fiscal year. The nominating and corporate governance committee met three times during our last fiscal year. During our last fiscal year, each director attended 75% or more of the aggregate of the meetings of our board of directors and of the committees on which he or she served.We encourage our directors and nominees for director to attend our annual meeting of stockholders, and six of our directors attended our annual meeting of stockholders in 2018.BOARD EVALUATIONS AND EDUCATIONOur nominating and corporate governance committee oversees the board evaluation process. The evaluation process has generally utilized a trusted third-party experienced in corporate governance matters, such as our outside counsel, to assist with the evaluation process. In the past, directors have been interviewed by the independent third party and gave feedback on directors, committees and our board of directors in general. Directors responded to questions designed to elicit information to be used in improving the effectiveness of our board of directors. The third party synthesized the results and comments received during such interviews. At subsequent meetings, Dr. Sands, in conjunction with the independent third-party, presented the findings to the nominating and corporate governance committee and our board of directors.We encourage directors to participate in continuing education programs focused on our business and industry, committee roles and responsibilities and legal and ethical responsibilities of directors, and we will reimburse directors for their expenses associated with this participation. We also encourage our directors to attend company events such as our annual company kick-off event and our user conference.TRANSACTIONS WITH RELATED PERSONSThe following is a summary of transactions since the beginning of our last fiscal year to which we have been a participant, in which the amount involved exceeded or will exceed $120,000 and in which any of our directors, executive officers or holders of more than 5% of our capital stock, or any member of the immediate family of the foregoing persons, had or will have a direct or indirect material interest.EMPLOYMENT ARRANGEMENTS AND EQUITY AWARDSWe have entered into employment offer letters with our executive officers and have adopted a Change in Control Severance Benefit Plan (as defined below). For more information regarding these arrangements, see the section titled “Employment, Severance and Change of Control Agreements.”We have granted equity awards to our executive officers and certain members of our board of directors. For a description of these equity awards, see the sections titled “Executive Compensation” and “Director Compensation.”INDEMNIFICATION AGREEMENTSOur amended and restated certificate of incorporation contains provisions limiting the liability of directors, and our amended and restated bylaws will provide that we will indemnify each of our directors and officers to the fullest extent permitted under Delaware law. Our amended and restated certificate of incorporation and bylaws also provides our board of directors with discretion to indemnify our employees and other agents when determined appropriate by the board of directors. In addition, we have entered into an indemnification agreement with each of our directors and executive officers, which requires us to indemnify them.24  PROPOSAL 1 ELECTION OF DIRECTORSRELATED-PARTY TRANSACTION POLICYWe have adopted a policy that our executive officers, directors, holders of more than 5% of any class of our voting securities, and any member of the immediate family of and any entity affiliated with any of the foregoing persons, will not be permitted to enter into a related-party transaction with us without the prior consent of our audit committee, or other independent members of our board of directors in the event it is inappropriate for our audit committee to review such transaction due to a conflict of interest. Any request for us to enter into a transaction with an executive officer, director, principal stockholder or any of their immediate family members or affiliates, in which the amount involved exceeds $120,000 must first be presented to our audit committee for review, consideration and approval. In approving or rejecting any such proposal, our audit committee will consider the relevant facts and circumstances available and deemed relevant to our audit committee, including, but not limited to, whether the transaction will be on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related-party’s interest in the transaction.DIRECTOR COMPENSATIONOur non-employee director compensation program is designed to attract, retain and reward qualified non-employee directors and align the financial interests of the non-employee directors with those of our stockholders. Pursuant to this program, each member of our board of directors who is not our employee (other than Dr. Dietzen) receives the cash and equity compensation for board service described below. We also reimburse our non-employee directors for reasonable out-of-pocket expenses incurred in connection with attending board of directors and committee meetings. A director may decline to accept compensation under the policy, or may direct us to donate the payments to the Pure Good Foundation or another charitable organization.

PROPOSAL 1 ELECTION OF DIRECTORSRELATED-PARTY TRANSACTION POLICYWe have adopted a policy that our executive officers, directors, holders of more than 5% of any class of our voting securities, and any member of the immediate family of and any entity affiliated with any of the foregoing persons, will not be permitted to enter into a related-party transaction with us without the prior consent of our audit committee, or other independent members of our board of directors in the event it is inappropriate for our audit committee to review such transaction due to a conflict of interest. Any request for us to enter into a transaction with an executive officer, director, principal stockholder or any of their immediate family members or affiliates, in which the amount involved exceeds $120,000 must first be presented to our audit committee for review, consideration and approval. In approving or rejecting any such proposal, our audit committee will consider the relevant facts and circumstances available and deemed relevant to our audit committee, including, but not limited to, whether the transaction will be on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related-party’s interest in the transaction.DIRECTOR COMPENSATIONOur non-employee director compensation program is designed to attract, retain and reward qualified non-employee directors and align the financial interests of the non-employee directors with those of our stockholders. Pursuant to this program, each member of our board of directors who is not our employee (other than Dr. Dietzen) receives the cash and equity compensation for board service described below. We also reimburse our non-employee directors for reasonable out-of-pocket expenses incurred in connection with attending board of directors and committee meetings. A director may decline to accept compensation under the policy, or may direct us to donate the payments to the Pure Good Foundation or another charitable organization.INPUT

PROPOSAL

PRESENTATION

OUTCOME Compensia provides input on program design considerations Proposes alternative program designs for consideration Presents competitive non-employee director compensation data and analyses including compensation data from our peer group Our board of directors approved increases in the annual retainers for service as a non-employee director, audit committee chair, and nominating and governance committee member, in each case effective as of May 1, 2018 Our compensation committee consults annually with Compensia, Inc. (Compensia), its independent compensation consultant, to review our director compensation program. As part of that annual review, Compensia provides input on program design considerations, proposes alternative program designs for consideration, and presents competitive non-employee director compensation data and analyses including compensation data from our peer group. For fiscal 2019, upon our compensation committee’s recommendation and consistent with Compensia’s recommendation, our board of directors approved increases in the annual retainers for service as a non-employee director, audit committee chair, and nominating and governance committee member, in each case effective as of May 1, 2018.2019 PROXY STATEMENT 25 PROPOSAL 1 ELECTION OF DIRECTORSCASH COMPENSATIONDuring fiscal 2019, eligible directors were entitled to receive cash compensation, paid quarterly in arrears, as follows:Annual Cash